Moneydance Review 2018 Quicken Replacement For Mac

If you're looking to replace, you're in the right place. For years, Quicken was the name in personal finance software. But let's accept reality – Quicken is often broken.

It doesn't sync your accounts problem, you have password problems, screens that should appear are blank, and it's just not a great experience. Sometimes it feels like they're just getting you to buy the newer version, right? Quicken was once the most popular and powerful personal finance management software out there. But Quicken isn't what it used to be.

It's hard to innovate a platform built in 1983. Back then, cell phones were bricks (if you could afford one) and apps were what you ordered at a restaurant.

Quicken has faced a lot of technical issues and its support is meh at best. (if you own Quicken for Mac, you know this headache first hand) In 2010, Intuit acquired Mint for $170 million.

In 2016, Intuit sold Quicken to private equity firm H.I.G. Look: If you're tired of Quicken, its support and sync issues, and want a suitable free alternative or replacement – we have some options.

Here are some of the best Quicken alternatives available: Our Best Picks. If you're quitting Quicken and want to move to a spreadsheet you can customize to exactly what you need, Tiller will automate all the data collection for you.

You build a spreadsheet (or use a template) and Tiller will pull the data for you. Thus, saving you a ton of time and hassle.

11 Best Quicken Alternatives:. – free financial dashboard and wealth planner.

– spreadsheet automation to bring it in house. – best in class budgeting tool & mindset.

– ad-supported budgeting tool. – compare your situation with your peers. – can import data from Quicken. – not cloud-based. – follows Dave Ramsey's Baby Steps.

– follows envelope budgeting method. – open-source and free. – date & calendar based budgeting 1. If you're a long time user of Quicken, you're beyond the “help me build my budget” phase.

If you're more interested how your investment account is performing and less interested in just knowing how much you're spending on groceries, Personal Capital is a great Quicken alternative (but it'll also pull your credit card transactions so you will know how much you spent on groceries if you want!). Personal Capital is a full-featured, free, personal finance management tool that focuses on helping you with investing. It has a powerful mobile app (also means it's a cloud-based service) that replicates the web experience. They're free because some users pay them for their wealth management services (optional). They are not stuffed with advertisements like some other free tools.

You can read my. Why it is a good alternative to Quicken: It's better than Quicken because it's updated, has a rich set of tools for investment and retirement, and it has a budget and expense tracking component. It's a website and not a software application, there's no software to download and patch or update (ugh) – that's all done automatically. I am a fan of their retirement planner, a tool that helps you project your future financial needs and whether you'll get there. It's worth checking out. One other vote of confidence for this Quicken replacement is their CEO – Bill Harris. He was formerly the CEO of Intuit and PayPal.

You know he has the leadership skills to dominate in this space and the ability to lead teams to build financial systems that are top notch (the rest of the leadership team is very impressive in their own right!). What could be better? The budget and expense tracking are good but it's not as old as Quicken, so it's not as developed as Quicken. I don't find it to be a negative because it works for me, but people with really complicated budgets may find it limiting.

Here's a brief over view video of Personal Capital's cash flow and budgeting tools. (since you access it with a browser, it is compatible with Mac OS!) 2. One of the most popular personal finance tools out there is a little software application known as Microsoft Excel. People love spreadsheets. You can customize it, tweak it, and get it tailored to exactly what you need. The only downside to spreadsheets is how you need to pull the data yourself and who really wants to do that? Quicken was great back in the day when there weren't nearly as many sync issues because it pulled the data for you.

There's a solution: Welcome – a $4.92 a month service (after a free 30 day trial) – that pulls your data for you and puts it into a Google Sheets or Microsoft Excel document. You can start with one of their free templates or build your own, but after the initial work you'll have a fully automated spreadsheet tailored to what you need. You can use this to track your net worth, set a budget, or anything else you can imagine. Why it is better than Quicken: Quicken is now cloud-based so if you want to avoid putting your data into the cloud, going with a spreadsheet is your best option.

Tiller makes it possible for you to get automation AND keep your data locally. Is one of the best budgeting software tools available. Think of it like Mint with a personality and a philosophy.

YNAB's philosophy revolves around four rules:. Give Every Dollar a Job. Embrace Your True Expenses. Roll With The Punches. Age Your Money Those four pillars form the foundation for a budgeting app that has helped many people transform their financial lives. If you're looking to transition to a financial tool that will help you (as in help you make the change, not just record expenses), you should take a look at. YNAB made a video showcasing the newest version plus a discussion on their philosophy.

Why it is better than Quicken: Quicken only tracks your budget, YNAB does that AND helps you build a budget that meets the demands of your life and your savings needs. If you want to change the way you budget, while still tracking it, YNAB is your solution. YNAB is not an entire personal finance management suite – it focuses on budgeting and only budgeting. You won't get investment tools, retirement planning, or wealth management. It's strictly about building, maintaining, and transitioning into the budget you want. You might have heard of these guys since they're now owned by the same company that once made Quicken. Intuit acquired them in 2010 and that's the reason why they shuttered Quicken Online shortly thereafter.

Later, Intuit sold Quicken to H.I.G. Capital and that's when you knew the end was near! Why it is a good alternative to Quicken: Mint is free and very powerful on the budgeting and expense tracking side. They do not have much to help you with investment and retirement savings, which I think you'll find is a huge limitation as you get older. The goal of Mint was always to be a budgeting app and with that in mind, they do a very good job. If you are sick of Quicken and focus entirely on expense tracking, Mint is a good Quicken alternative. It, like, is cloud-based so there's no software to download, patch, or update.

If you have investments and want to manage those, Mint will not be able to adequately fulfill your needs. Status Money is a free cloud-based budgeting tool that lets you compare your finances with people around the United States. It offers all of the tracking functionality of these other tools, will always be free, but adds the comparison component so you can see how you are performing against your peers and against the National Average. Your peer groups are set by your age range, income range, location (location type), credit score range, and housing status (own, rent).

This ensures you are getting a true apples to apples comparison and you aren't compared with someone in another age group, different cost of living, or life phase. You can also build custom groups too if you feel you're in a special situation not captured by basic demographic information. CountAbout The founders built CountAbout to be a Quicken alternative. Founded in mid-2012, it is one of the only personal finance apps that will import data from Quicken (and Mint!). If you're looking to transition away from Quicken but worry about losing all your data, you can feed it your Quicken file and it'll populate itself. That'll make the transition far less painful!

Like Quicken, CountAbout isn't free but it costs $9.99 for the Basic subscription and $39.99 for Premium subscription. The Premium subscription includes automatic transaction download. A subscription model means you have complete data privacy and you won't get annoying ads like with Mint.

Why is it a good alternative to Quicken? CountAbout has a lot of similar features to Quicken’s: split transactions, recurring transactions, attachments, budgeting and more. CountAbout is web-based, with multi-factor account security, so you don't have to download a program onto your computer, and there's no need to deal with unwieldy syncing issues – all you need is a web browser. And with CountAbout’s iOS and Android apps, your financial information is always at your fingertips. Check out the key features (reminds me a lot of Quicken). Individual Account QIF importing. Budgeting.

Running register balances. Account reconciliation. Graphs for Income & Spending.

Recurring transactions. Investment balances by Institution. Memorized transactions. Split transactions. Description renaming. Invoicing 7.

MoneyDance is not as well known as some of the other alternatives I've listed but I wanted to mention them because they're one of the few money apps that doesn't rely on the cloud. If you are concerned about your data being stored online, this solution is an alternative that keeps your data local to your computer. You can still link your accounts online, so they pull your transactions in automatically, but they only store them on your computer. You can enter transactions manually if you didn't want to link your accounts.

MoneyDance looks and feels like a checkbook, with the check register for transactions, but has charts and tables for reporting. It does budgeting but can also as well, albeit not as feature rich as others. MoneyDance is free to download and try but it costs $49.99. The free version has all the features as the paid version. The free version's limitation is that you can only enter 100 manual transactions. Have you heard of Dave Ramsey?

Many folks swear by his approach and is built with that in mind. His approach takes into account human psychology, rather than relying solely on math, and explains why it is so effective. It also explains why ideas like the debt snowball work so well, we need to work with our biases and tendences if we hope to succeed. EveryDollar is a budgeting tool affiliated with Dave Ramsey's group, the Lampo Group. Much like YNAB, it's a budgeting tool that uses the principles of zero-based budgeting. In zero-based budgeting, you assign every dollar to a category (or job, in YNAB parlance). It's a level of rigor that can be refreshing or restricting, depending on your personality.

The app itself is beautiful, available on your smartphone, and there is both a free and paid version. The paid version costs $99 a year. (paid version offers phone support and automated transaction importing which is a big time saver; otherwise, you must manually enter the data) Here's a tutorial video on how to build a budget. GoodBudget is a free budgeting app based on the envelope budgeting method. Envelope budgeting is when you set aside a prescribed amount for each category of spending, then spend it down each month. It's one of the most popular money management techniques in personal finance.

The envelope refers to the manual method of managing these types of budgets where you put the money into an envelope. When you run out of money, you either borrow cash from another envelope or you make do. GoodBudget adds technology to the mix and will synch up bank accounts to help track your income and your spending. You set the amount for each category and then watch as your spending nears the limit each month. It's available for both iOS and Android phones. GnuCash is a free open-source accounting software that, if you're willing to put into the work, can replicate a lot of the Quicken experience for those who are willing to scale the learning curve.

It features double-entry accounting (every transaction must debit one account and credit another), which is effective but will require an adjustment if you're not used to it. It offers a lot of the functionality of Quicken like splitting transactions, categorizing transactions, managing multiple accounts, schedule transactions, and reporting that includes all kinds of charts and reports (balance sheet, P&L, portfolio valuation, etc). The big benefit is that it does budgeting as well as investments.

It's not strictly a budgeting tool. Lastly, it offers QIF importing, so you can import your Quicken files, plus OFX (Open Financial Exchange) protocol. So you can pull in your data if your bank offers you the ability to export transactions. Dollarbird is another personal finance app with an eye towards collaboration and a monthly calendar. You synchronize your accounts (banking, brokerage, and credit cards) with Dollarbird and they build a schedule of future income and expenditures to help with planning. Dollarbird also offers a 5-year financial plan that lets you establish longer-term financial goals and track your performance against them.

The innovation they bring to the table is the idea of calendar-based money management. You can collaborate with other people (partner, family, or a team) to manage a team budget, though the collaborative piece requires the Pro version ($39.99 / year). One of these will make a fine replacement for Quicken. Is there a Quicken Online? Intuit created Quicken Online to try to compete with Mint. Near the end of 2009, they gave up and acquired Mint.

Afterward, they opted to shut down Quicken Online and sold the entire Quicken unit to H.I.G. Capital in 2016. Quicken Online no longer exists. Quicken does have an online experience, something they've only recently created, but it's not free and it's playing catch up. Why is budgeting so important? A lot of folks start using Quicken to help them maintain a budget. As the tool started having problems, you may be tempted to quit altogether.

We wanted to briefly discuss why budgeting, whether with Quicken or one of these other alternatives, is a good idea. For that, we turned to: 1. Why do you believe it is important for individuals to budget? Professor Ariel Belasen, Associate Professor of Economics and Finance at Southern Illinois University EdwardsvilleWith credit card spending superseding cash spending as the predominant form of payment, it’s especially important for people to budget because it’s tougher to experience the “slim wallet feel” of spending. Instead, the impact of spending hits all at once on each credit card statement. That means overspending is far more likely – and far more costly given that credit card interest rates are on the rise again.

Many folks think of budgeting as tracking what you've spent, how do forecasting and planning fit into budgeting? Most people spend more on fixed expenses each month than on variable expenses. Fixed expenses are your mortgage or rent, utility bills, phone and internet bills, daycare expenses, etc. The largest variable expenses are typically food and transportation. Planning a month or two ahead will not only help you keep track of what you have already spent, but it will give you an idea of what you can spend moving ahead. It’s also important for people who enjoy taking a vacation or who want to make a large purchase in the future.

Moneydance Review 2018 Quicken Replacement For Mac Pro

Planning ahead can help an individual figure out how much disposable income should be saved each month. Personally, how do you budget and how has that changed over the years?

I use Microsoft Excel and I plan a quarterly budget which, at this point, revolves around my childcare expenses. But prior to having children I used to budget out one month in advance so that I could be sure to allocate a certain amount to savings. I find it easiest to put together a simple balance sheet listing when paychecks come in and when various bills or direct debits will come due. If you were advising a student or recent graduate on budgeting, how would you suggest they get started? First of all, I’d recommend calling their credit card company to place a hard cap on their spending limit (preferably well below the overall card limit) so they do not exceed a fixed amount of spending or incur penalties for exceeding their card limit. Once that preventative step is taken, the rest involves keeping track of due dates for bills and deposit dates for paychecks. I would recommend just looking at the current month at first and then eventually expanding out to the month ahead as well.

Saving is far less important for students since their income will rise quite a bit after graduation, but falling into default on their personal debt can haunt them for years. Jim Wang is a thirty-something father of three who has been featured in the New York Times, Baltimore Sun, Entrepreneur, and Marketplace Money. Jim has a B.S.

In Computer Science and Economics from Carnegie Mellon University, an M.S. In Information Technology - Software Engineering from Carnegie Mellon University, as well as a Masters in Business Administration from Johns Hopkins University. One of his favorite tools is, which enables him to manage his finances in just 15-minutes each month. If you sign up and link up an investment account with $1,000+ within 40 days, you get a $20 Amazon gift card. They also offer financial planning, such as a Retirement Planning Tool that can tell you if you're on track to retire when you want. He is also diversifying his investment portfolio by adding a little bit of real estate.

But not rental homes, because he doesn't want a second job, it's diversified small investments in a mix of properties through. Worth a look and he's already made investments that have performed according to plan. An important point about CountAbout is that the $9.99 or $39.99 is per year!

That’s pricey, even surpassing Quicken for all but the simplest of accounts. I prefer a one-time fee rather than the constant reach into my wallet. I chose Ace Money which is a very good substitute for Quicken on a PC (the Mac version runs via an emulator. Hopeless and looks like a DOS program). As I recall it was something like $60 one time and syncs most accounts pretty well. MoneyDance I found very simple and a poor substitute.

I’m happy with the switch to Ace money and have moved on from Quicken. I have used Quicken for many years, ever since Microsoft Money was discontinued. It used to be great but today it is fraught with errors that cause me to spend more time trying to figure out what is wrong with the application and sync than I spend managing my spending and investments. I really do not want a cloud-based application. Call me old school but like have all of my information on my personal computer or in my file cabinets. Really ready for a STABLE alternative that can download my CC and investment transaction and reconcile correctly. Kind of like Quicken used to be?

I have been a Quicken Home & Business user for many years, in the US and more recently in Canada. The Canadian operation has now moved to a subscription mode and the Home & Business version now has an annual subscription fee of $90 per year – to me, that’s a real ripoff. To discourage you from continuing to use your current, non-subscription version, they have now disabled two key features – downloading & categorizing transactions from financial institutions and downloading stock quotes. I have tried all the major alternatives out there, and my favorite by far is one I rarely see mentioned – KDE’s KMyMoney. Just tried MoneyDance and CountAbout – the two closest things to what I’m looking for – and found them worse than even Quicken for the features I really care about.

I just want an easy to use electronic register I can enter transactions into for all my accounts then reconcile against statements as they come in. Not much to ask.

And I think just about EVERYONE I know wants one too. We all hate Intuit software but are reluctantly using it because nothing else out there does the two things Intuit does reasonably well: Easy, rapid transaction entry and account reconciliation. Of course, lately it seems that Quicken is just getting worse with each new release. Bugs creep in and are never fixed. I think maybe it’s time to just write my own solution and get insanely rich off it.

There’s a huge market out there for an easy to use electronic register. Can’t understand why nobody is jumping on it to knock Intuit off that hill they occupy all by themselves. For several years I used MoneyCounts a very simple program but it was bought out and ended up being discarded by Intuit and users advised to use Quicken. I to want a simple program that will keep an electronic register on multiple bank accounts and capable of downloading bank transactions that is not cloud based.

Some of the newer programs will do a wonderful job of budgeting but will not give a decent P&L or Income & Expense report that is helpful for the preparation of one’s tax reports. I tried Moneydance but could never link it to download transactions from any of my banks in mid-America. Would someone please come up with a simple accounting program. While not being a budgeting program per say if it had the capability of doing fund accounting an individual could allocate their income to the various funds and be directly subtracted when the expenditure account (whether called a Category of account is set up to come from a given fund) is posted to in the register. I used Quicken 2007 for home and business (Windows version) for 10 years.

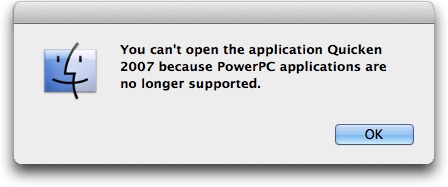

Tried the upgrade to 2011 but went back to 2007 version as new features were just complications. Now we have switched to Mac computers and bought 2017 Quicken for Mac. Hugely disappointed, can’t even print a reconciliation statement along with the illogical interfaces. Much more complicated than the Windows versions I’m used to.

I agree with the comment above. We need a simple way to keep our basic financial accounts and good reminders when bills come due. A good “simple” old fashioned system really would sell to most of us. Just the essentials please!!