Turbotax Basic, Deluxe, Premier And Home Business Free For Mac

. Credit Cards.

Best of. Compare cards. Reviews. Read & learn. Banking.

Best of. Compare accounts. Reviews. Read & learn.

Investing. Best of. Reviews. Popular tools.

Guides. Mortgages.

Best of. Compare. Calculators. Read & learn. Loans. Personal. Small business.

Student. Auto. Insurance. Auto. Life. Money. Managing Money.

Ways to save. Making money. Life events.

Travel. Travel. Best of.

Reviews. Popular tools. Guides. At TurboTax TurboTax’s prices TurboTax has a lot of things going for it, but price isn’t one of them. The list price of its software routinely lands on the high end of the spectrum, especially when you factor in the added cost of a state return.

The provider and some retailers sometimes offer discounts. Military discounts are available, too — typically $5, though the Deluxe version might be free, depending on rank. But on balance, buying TurboTax means spending more.

TurboTax’s free federal version is available only to people who. Folks filing a regular 1040 will need to go with one of the paid versions.

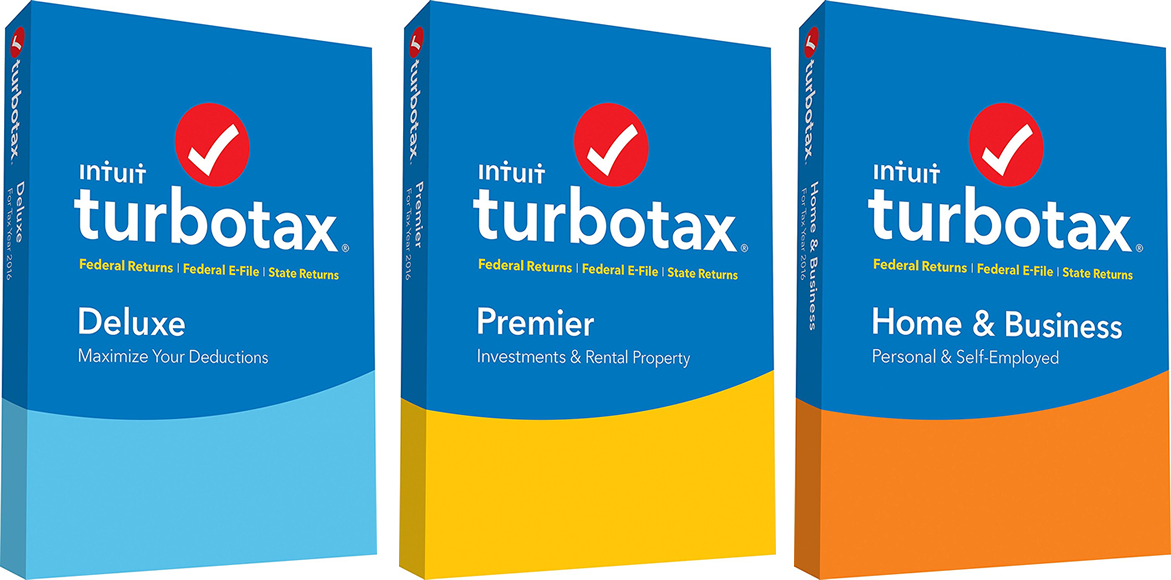

Available packages and list prices. Free edition Federal: $0 State: $29.99 This option allows you to file a 1040EZ or 1040A. Deluxe Federal: $59.99 State: $39.99 This version lets you itemize, includes the ItsDeductible feature for calculating the value of donated items and gets you the SmartLook support option.

This product launches many versions. UltraISO Premium Edition Overview ULTRAISO PREMIUM EDITION software is developed by ezbsystems and compatibles for windows Operating Systems. Its full working offline Setup.  It is an burning product. They develops software’s for windows OS.

It is an burning product. They develops software’s for windows OS.

TurboTax will store your tax documents, too. Premier Federal: $79.99 State: $39.99 Gets you everything that's in the Deluxe version plus added capability for reporting your investments and income from rental properties. Self-Employed Federal: $119.99 State: $39.99 Gets you everything in the Premier version plus deduction help and expense-tracking features for freelancers, independent contractors and side-hustlers. TurboTax Live Federal: $179.99 State: $39.99 New this year, this package handles virtually every form the IRS can throw at you, plus you get a one-on-one review with a CPA or Enrolled Agent before you file, as well as unlimited live tax advice from an on-screen CPA or EA.

One note about prices: Providers frequently change theirs. We’ll keep updating this review, but you can verify the latest price by clicking through to TurboTax’s site. TurboTax also offers desktop software, but it’s not part of our review. Desktop means your return doesn’t reside in the cloud; it stays on your computer while you work on it. People who have used the desktop version before will see a cosmetic difference with the cloud, but the steps are similar — and, of course, the math is the same. TurboTax’s features and ease of use TurboTax’s products are some of the most user-friendly on the market, and for good reason. Like many other providers, TurboTax’s cloud software lets you access and work on your return across devices: on your computer via the website or on your phone or tablet via an app.

So you could import your W-2 information from your employer, but you also could snap a photo of the form with your mobile device and see all the data transferred to your return. The latter is especially helpful if you have multiple W-2s. Getting help throughout the preparation process is TurboTax’s biggest strength — especially this year. A banner running across the top keeps track of where you stand in the process and flags areas you still need to complete. TurboTax’s interface is like a chat with a tax preparer. The software asks questions in plain language and puts your answers in the right place on your return.

You can skip around if you get sick of the interview process, or you can ditch it altogether and go straight to the forms if you’re feeling bold. Paid users also get ItsDeductible, a feature — and standalone mobile app — that’s helpful for quickly finding the deduction value of donated clothes, household items or other objects. These users also get access to and protection of their past tax returns.

TurboTax’s Self-Employed version offers a neat expense-tracking feature through QuickBooks, including the ability to store photos of your receipts and track mileage from your phone. New this year is a feature that calls attention to common deductions in your industry. Expense Finder and ItsDeductible are designed in part for you to use after the April deadline, to become yearlong habits that will make next year’s taxes easier — and, of course, to keep you using TurboTax. Searchable knowledge base. Online community. Video tutorials.

Live, on-screen human help (if you paid for it). Users with paid versions also get real-time help using SmartLook, which connects you to a tax specialist via one-way video using the TurboTax mobile app or your computer. You can ask questions, and they can see your screen and highlight areas you might need to address or show you where to enter more information. SmartLook isn’t available with the free version, however. New this year is TurboTax Live — a high-end software package that offers a one-on-one review with a certified public accountant or enrolled agent before you file, as well as unlimited live tax advice from an on-screen CPA or EA. You can make an appointment or talk on the fly to the advisors via one-way video (you see them, but they don’t see you — they just see your screen). Hours of operation are 5 a.m.

Local time in general, though that may widen during tax season. All of the agents are CPAs or EAs and are employees of TurboTax; they’ll even sign and e-file your return if you want.

Help is available via chat, too. In other words, SmartLook is a little more like product support and TurboTax Live is closer to tax advice.

The price difference is considerable — it can be as much as $100 — and many filers might be just fine with the less-expensive option. The company also launched an Alexa skill this year, which means users can ask Amazon’s voice-activated device to check in on their return status, check their refund amount or track their refund. If you buy a paid version of TurboTax, you have the option of paying for it out of your refund, if you’re getting one. But there’s a $39.99 charge. If you’re audited Audit support comes free with all versions, but be sure you know the difference between “support” and “defense.” If you get that dreaded letter from the IRS, audit support entitles you to one-on-one guidance from a tax pro about what to expect and how to prepare.

Audit defense, on the other hand, gets you full representation before the IRS by a tax professional. TurboTax’s audit defense, called Max Assist and Defend, is an add-on product. You’ll need to buy it when you file; you can’t do it after the fact.

It costs $44.99. Refund options No matter how you file, you can choose to receive your federal refund via direct deposit to a bank account — that’s the fastest option. You can also have your refund loaded onto a TurboTax Prepaid Visa Card. Other options include getting an old-fashioned paper check, applying the refund to next year’s taxes or directing the IRS to buy U.S.

Turbotax Basic Deluxe Premier And Home Business Free For Mac Download

Savings Bonds with your refund. If you’re getting a refund on your state taxes, see if your state offers a prepaid card option as well.

You have the option of paying for the software out of your refund (if you’re getting one). But there’s a $39.99 charge to do that. TurboTax stands out for how easy it is to use and its intuitive design and flow. It’s pricier than most, but while confident filers may not need the bells and whistles and can find better value elsewhere, many people will find this experience to be worth a few extra dollars. H&R Block’s software is a solid contender in the crowded market for tax software, and its network of brick-and-mortar locations offers a warm, fuzzy security blanket. The interface is straightforward and easy to use, and the free version is one of the best on the market.

Turbotax Basic Deluxe Premier And Home Business Free For Mac 2017

TaxAct’s no-nonsense design will be a turnoff for some, but the cost is lower than many competitors and there’s phone and chat support. The interface isn’t fancy, and there’s less of a Q&A feel than other packages, but the data-entry process in general is similar to most and there are plenty of tools to help you along.

The bottom line With its cutting-edge support and comprehensive design, TurboTax is in many ways the standard for the do-it-yourself tax-prep industry. Its products come at a price, however, and confident filers who don’t need all the bells and whistles may get a better value elsewhere.

Disclaimer: NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. Pre-qualified offers are not binding. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

TurboTax Premier 2005 Intuit TurboTax Premier for 2005 is the easiest-to-use tax-preparation software for do-it-yourself filers. This year's upgrades, though not dramatic, include a simplified interface that makes the tax interview easier to navigate. This is particularly helpful for nonlinear filers who like to jump between different sections-say, from wages to IRA contributions, then back to investment income. TurboTax 2005 excels at demystifying IRS terms and doing so in as few words possible. Intuit has done away with the much-hated mail-in rebates, and installation is easier now that federal and state editions are included with TurboTax Deluxe and Premier. Unlike its leading competitor, TurboTax doesn't provide post-tax-return IRS audit support (with fees starting at $29.95 for a standard 1040 return), but we were impressed by its well-crafted and superior tax interview.

Editors' note: We previously stated that Intuit TurboTax does not provide IRS audit support. It does, but unlike H&R Block TaxCut, Intuit charges a fee for its TurboTax IRS audit support, starting at $29.95 for a standard 1040 return. (1/3/2006) TurboTax 2005 is easier to install than version 2004. Both federal and state editions, which used to ship separately, now come on a single CD (Deluxe and Premier editions only). Plus, you no longer have to fuss with annoying rebates. This doesn't mean you're paying more; TaxCut 2005 has done away with rebates, and in fact, Premier 2005 costs the same as the after-rebate 2004 version. For this review, we looked at TurboTax Premier 2005, and setup was a no-brainer; it took just a few minutes.

Turbotax Basic Deluxe Premier And Home Business Free For Mac Pro

Once the federal program installs, you select your state from a list. TurboTax then installs the state app and downloads updated program files and IRS forms, which can take several minutes via a dial-up Net connection or mere seconds via broadband. If you've moved around a lot in the past year, you can also install and use more than one state program. TurboTax steps you through each state separately.

If you changed jobs in 2005, the interview walks you through that as well. Intuit has done a solid job of fine-tuning the TurboTax interface without gutting the already solid design, giving TurboTax 2005 a slight ease-of-use edge over TaxCut 2005, which is also simple to navigate. In TurboTax, it's easier to hop around the interview, thanks largely to its third row of submenus. This row thankfully replaces the EasyStep Navigator, a pop-up box that provided a lengthy list of interview sections and typically required some tiresome scrolling. If you liked the old interface, fear not: The EasyStep Navigator is still available, although it's buried in the Tools menu. TaxCax, by comparison, provides a navigational tool similar to TurboTax's EasyStep Navigator. TurboTax Premier 2005 also adopts time-saving features used by online tax-prep services, including TurboTax Online.

New summary screens allow advanced users to quickly enter information such as wages, interest, IRA distributions, and so on without enduring a lengthy interview. New users aren't forgotten, though. If you're unsure about what information to enter, simply click the 'Walk me through all' button for a step-by-step interview with plenty of hand-holding.